After decades of chronic underfunding, the Commonwealth Court has ruled that Pennsylvania’s current K-12 education funding system is unconstitutional and must be rectified. The Basic Education Funding Commission released a report in January 2024 recommending $5.1 billion in state investment over the next seven years to ensure students have the resources necessary to meet state achievement standards. Despite this court mandate, some lawmakers in Pennsylvania are considering expanding our existing private school voucher tax credit programs or creating a whole new voucher system. Pennsylvania doesn’t have a public dollar to waste on funding private schools – schools that can and do discriminate and operate without any financial or educational accountability.

PENNSYLVANIA’S PRIVATE SCHOOL VOUCHERS: The state of Pennsylvania currently funds two types of private school voucher programs. These received a combined total of $470 million in PA taxpayer funds in 2023-24 and have received roughly $2.6 billion since 2001.

- Educational Improvement Tax Credit (EITC): The EITC program was first funded in 2001 and provides tax credits to businesses that donate to a scholarship organization (SO) for private school scholarships, as well as tax credits for Educational Improvement Organizations that deliver innovative programs to public schools and scholarships for children to attend pre-school. This report focuses on tax credits to scholarship organizations.

- Opportunity Scholarship Tax Credit (OSTC): The OSTC program was first funded in 2012 and provides tax credits solely to corporate contributions to non-profit SOs that provide vouchers to attend private schools. These scholarships must go to students living in a “low achieving” school zone, defined as the state’s bottom 15 percent of public schools based on standardized test scores.

Pennsylvania’s existing voucher programs fund private and religious schools that are expensive, discriminatory, and exclusive.

PA’S VOUCHER PROGRAMS ARE EXPENSIVE

Funding for EITC and OSTC scholarships to private schools has skyrocketed since their inception. Considering both categories, funding caps for these programs grew by 488% from $80 million in 2012-13 to $470 million in 2023-24. Total EITC and OSTC funds available since 2001 have equaled over $2.6 billion.

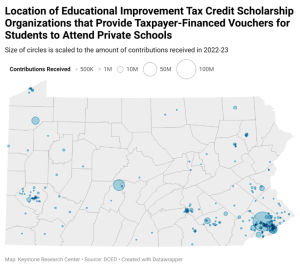

ALL STUDENTS IN PA DO NOT BENEFIT EQUALLY FROM VOUCHER PROGRAMS—STUDENTS IN RURAL COMMUNITIES OFTEN DON’T HAVE ACCESS

Both the taxpayer-funded vouchers in the newer OSTC program and the EITC program serve primarily large urban areas of the state, especially in southeastern, south-central Pennsylvania, and Allegheny County. Especially in rural areas of the state, the main, and sometimes only, K-12 school option remains local public schools.

PRIVATE SCHOOLS RECEIVING VOUCHERS DISCRIMINATE

Private schools in Pennsylvania that receive EITC and OSTC funds can and do discriminate against students on the basis of disability, race, level of income, religion, LGBTQ+ status, or because they are not the “right fit” with the school. A survey of schools listed on the Pennsylvania Department of Education website as participating in the Opportunity Scholarship Tax Credit (OSTC) program completed by Education Voters of PA found policies at 100% of the schools allowing for discrimination on the basis of religion, LGBTQ+ status, disability, or other reasons.

PA’S VOUCHER PROGRAMS HAVE LITTLE ACCOUNTABILITY

Pennsylvania’s OSTC and EITC voucher programs provide funding for students to attend private schools, but do not require that students participate in state achievement tests or that scholarship organizations provide demographic information on scholarship recipients. In fact, Act 46 (2005) explicitly prohibits the state from collecting data about voucher programs or students that is not enumerated in state law. Because of this, a 2022 IFO report concluded that an accurate evaluation of the program impact was not possible due to a lack of information.

VOUCHERS SUBSIDIZE ELITE AND EXPENSIVE PRIVATE SCHOOLS

Just 24 of the most exclusive – and most expensive (average tuition of $41,497) – Pennsylvania private schools received at least $16.7 million in EITC and OSTC tax credits in 2022-23. The Episcopal Academy in Newton Square alone received nearly $5 million. We know nothing about the socio-economic characteristics of the Academy’s voucher students, whether scholarships are reaching low-income kids, or if the program is impacting the income and racial/ethnic diversity of the school.

FUNDING RELIGIOUS SCHOOLS THAT TEACH CREATIONISM AS SCIENCE AND THE BIBLE AS LITERAL HISTORY

This report estimates that at least 78% of the funds for OSTC and EITC vouchers go to religious schools – about $240 million dollars in 2022-23. In Pennsylvania, religious schools do not have to be accredited or abide by meaningful curriculum standards.

While many religious schools do teach curricula similar to public schools, there are some private religious schools that teach curricula based on theological dogma instead of facts and offer young-earth creationism as science. Teaching creationism as science was banned in 2005 in Pennsylvania’s public schools, but the EITC and OSTC programs have provided a way for some private schools to continue the practice despite receiving public money.

In some non-Catholic religious schools receiving EITC/OSTC funds, students are taught curriculum including the following content: earth being described as only a few thousand years old, and fossils and geologic formations described as the results of Noah’s flood; environmentalism presented as a religion in conflict with Christianity; the hardships of slavery downplayed; and more.

CONCLUSION:

With vouchers being pushed by some lawmakers and Governor Josh Shapiro signaling his support, this report highlights real concerns including financial and educational accountability of the OSTC and EITC voucher programs.

Unfortunately, as this report documents, the existing accountability of the OSTSC and EITC programs is wholly inadequate. Leaving aside the question of whether vouchers are good educational policy, at minimum, we should not expand these programs without basic financial and educational accountability in place. On the financial front, we are setting Pennsylvania and our taxpayers up for significant misuse of state funds. On the education front, we are setting our students up for attending schools that fail to deliver educational quality as well as fueling social division and intolerance. Both outcomes are unacceptable. Pennsylvania lawmakers should be focusing on the very real education funding mandate that came from the Commonwealth Court in early 2023. Our public schools—which have strong financial and educational oversight and educate all our students without discrimination—need significant investments to bring our school funding system into constitutional compliance. Increased investment in our public schools as outlined by the Basic Education Funding Commission, not increased funding for unaccountable private schools, will have the most impact on our children’s lives.