Two thirds of the members of the Pennsylvania Minimum Wage Advisory Board sent a letter to state lawmakers today recommending that they increase the state’s minimum wage to $15 per hour, as neighboring New York, New Jersey, and Maryland have already done. The Advisory Board members’ letter also recommended allowing localities to establish higher minimum wages and eliminating the subminimum wage for tipped workers. Below is the full text of the letter, including “end notes” below the signatures that include sources.

“Dear Member of the Pennsylvania General Assembly:

The Minimum Wage Advisory Board of the Pennsylvania Department of Labor and Industry (DLI) is a nine-member body that consults with the Secretary of Labor and Industry on matters relating to the minimum wage. The board consists of three members from labor organizations, three from employer associations, and three from the general public. The Board submits an annual report to the General Assembly on the state of minimum wage workers across the Commonwealth and can make recommendations to the state legislature. On February 10, the Board voted 5-3 in favor of the following recommendation to the General Assembly (with all employer representatives voting against and one labor representative absent):

“This Board has reviewed years’ worth of data in compiling reports showing the decreased purchasing power of a $7.25 minimum wage and its failure to provide a living wage to Pennsylvanians, let alone to keep families above the poverty line. Meanwhile, Pennsylvania’s elected representatives have taken no action to raise the minimum wage since 2006, while every surrounding state has done so. This Advisory Board hereby recommends the following to the legislature:

- The Pennsylvania General Assembly should raise the minimum wage to $15;

- Localities with higher costs of living should be permitted to increase it further;

- The Commonwealth should abolish the subminimum wage for tipped workers.”

Subsequent to the vote, the Board was informed by DLI counsel that this voted-upon recommendation must be transmitted in the form of this separate letter to the legislature. This letter is signed by the five board members who voted yes and the absent labor representative.

The Minimum Wage Situation

This year’s report from the Pennsylvania Minimum Wage Advisory Board report, delivered to the legislature earlier this month, shows that in 2021 there were an estimated 63,800 Pennsylvania workers earning at or below the current Pennsylvania $7.25 per hour minimum wage; in 2020 this number was around 74,400.[1] The 2021 number is only about 1% of our state’s nearly six million workers, one indication that the current Pennsylvania minimum wage is so low as to be irrelevant to the wages of the vast majority of workers (although our state does rank third for the number of workers earning below $7.25 behind Florida (#2) and Texas (#1), a badge of dishonor and well above several much more populous states).[2] Another indication from the new Advisory Board report that our minimum wage is so low that it does nothing to raise the wages of most workers: last year, only 713,600 Pennsylvania workers earned less than $12 per hour, less than one out of eight people employed in Pennsylvania.[3] Wage increases to offset a high rate of inflation (7.5% in 2021 according to the Bureau of Labor Statistics) will also reduce this number quickly.

A Living Wage

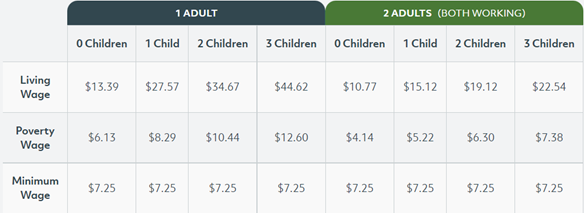

Our low state minimum wage increases the number of families in our state that do not earn a “living wage”—i.e., enough to cover the costs of a bare bones budget without public assistance. Researchers at the Massachusetts Institute of Technology have developed a living wage calculation, showing the hourly rate that individuals must earn for 40 hours per week, 52 weeks per year to support themselves.[4] For Pennsylvania as a whole, this living wage estimate is $13.39 for a single adult with no children. The poverty wage for this individual is $6.13 per hour. For the average single childless worker in Pennsylvania, the minimum wage of $7.25 is much closer to the poverty wage than a living wage. Living at or near poverty is associated with a host of negative cumulative effects that can impact someone for a lifetime.

Living Wage Calculation for Pennsylvania[5]

Many opponents of a $15 per hour minimum wage argue that regional differences exist in living wage levels, and that workers in less populous counties can live on much less. In Pennsylvania today, however, regional variations make the argument that we need a $15 per hour minimum wage throughout our state. In Pennsylvania’s least populous county—Cameron—the living wage for that single individual with zero children is $12.24. Therefore, even with a wage bump to $12 by 2022, a Cameron County single adult would still be below a living wage. Add a single child, and that adult needs $24.81 to earn a living wage. In a Cameron County family of two working adults and one child, each adult would need at least $13.74 per hour to earn a living wage. That’s $13.74 in Cameron County right now, not over four years from now, when it’s scheduled to be in that range under the Governor’s current proposal. Meanwhile in Pennsylvania’s most populous county—Philadelphia—the minimum wage wouldn’t hit the living wage for a single adult until 2027 under the Governor’s proposal. For a family with two working adults and one child in Philadelphia County, $15 by 2028 is $1.28 less than each adult needs to earn to reach a living wage, working full time, every single week of the year.

Many opponents of a $15 per hour minimum wage argue that regional differences exist in living wage levels, and that workers in less populous counties can live on much less. In Pennsylvania today, however, regional variations make the argument that we need a $15 per hour minimum wage throughout our state. In Pennsylvania’s least populous county—Cameron—the living wage for that single individual with zero children is $12.24. Therefore, even with a wage bump to $12 by 2022, a Cameron County single adult would still be below a living wage. Add a single child, and that adult needs $24.81 to earn a living wage. In a Cameron County family of two working adults and one child, each adult would need at least $13.74 per hour to earn a living wage. That’s $13.74 in Cameron County right now, not over four years from now, when it’s scheduled to be in that range under the Governor’s current proposal. Meanwhile in Pennsylvania’s most populous county—Philadelphia—the minimum wage wouldn’t hit the living wage for a single adult until 2027 under the Governor’s proposal. For a family with two working adults and one child in Philadelphia County, $15 by 2028 is $1.28 less than each adult needs to earn to reach a living wage, working full time, every single week of the year.

The Congressional Budget Office Report

With each new federal proposal to raise the minimum wage, the Congressional Budget Office has released a report on the impact of a higher minimum wage, highlighting who would see a pay increase, how many people would be lifted out of poverty, and how many jobs are predicted to be lost. Opponents of a $15 minimum wage center this last point and hold up potential job loss as an essential element of their argument against raising the wage. It is important to note, however, that the CBO estimates of job losses are tiny compared to CBO estimates of how many workers would see wage increases; and to note, further, that many leading economists and a wealth of economics research cast doubt on the CBO’s claims and methods. The CBO’s estimate has been critiqued because it “doesn’t reflect the best economic evidence.”[6] This evidence is based on sophisticated statistical analyses that compare real-world employment trends when large numbers of states increased their minimum wage with trends in states that did not increase their minimum wage. In sum, the CBO’s assumptions on the scale of job loss “are just wrong and inappropriately inflated relative to what cutting-edge economics literature would indicate.”[7]

Minimum wage studies of employment impacts focus on low-wage jobs, those most heavily impacted. A recent study by Cengiz, Dube, Lindner, and Zipperer published in the Quarterly Journal of Economics—one of the most highly regarded peer-reviewed economics journals—estimates the effect of minimum wages on low-wage jobs, using data from 138 instances of state-level minimum wage changes from the late 1970s to 2016. Using a respected econometrics method that brings with it the weight of causal analysis, the authors found virtually unchanged total employment impacts—while the number of jobs declined below the new minimum, there was a nearly equal increase in the number of jobs at or above the new minimum wage. The minimum wage increases in the United States that these authors studied—raising the minimum to between 37% and 59% of the median wage—“have yet to reach a point where the employment effects become sizable.”[8]

The findings above, and the range of state wage increases studied in the most powerful minimum-wage research, are especially instructive in the current Pennsylvania context. As we will show, they drive home how reasonable is Governor Wolf’s proposed increase to $12 per hour on July 2, 2022. The May 2020 State Occupational Employment and Wage Estimates from the Bureau of Labor Statistics put Pennsylvania’s median hourly wage at $20.08.[9] Between 2020 and 2021, the average weekly wage in Pennsylvania increased 4.3%.[10] If the median hourly wage increased by a similar amount in the last year, the Governor’s proposed minimum wage increase to $12 per hour by July 1, 2022 would be 57% of the median wage—still within the range analyzed so carefully by Cengiz, Dube, Lindner, and Zipperer. The subsequent 50 cent yearly increases until 2028 would each be a very modest increase. In fact, they would be no increase at all in real terms if inflation persists at 4% or above.

In Conclusion

Researchers critical of the CBO’s estimate understand that there is concern about unintended consequences of the minimum wage on employment. This concern stems from the simplest conventional supply and demand models: as labor costs more, employers may buy less of it. The real-world data reviewed in the most powerful academic studies demonstrate that simplistic supply and demand models do not fully capture the impacts of a higher minimum wage. Experience shows that a higher minimum wage can also increase employment. For starters, it puts more money in the pockets of working families, and boosts consumer demand. Minimum wage increases also create jobs by reducing unfilled job openings and rates of turnover. More employers can achieve the optimal staffing levels that they want and not be perennially short-staffed.

In closing, while many argue that we can’t afford to raise the minimum wage, the evidence above shows that we can’t afford not to.

In a sea of numbers and questions surrounding the impact of a higher minimum wage, it is important to ground oneself in an idea at the heart of the minimum wage, established by the Fair Labor Standards Act signed in 1938 by President Franklin D. Roosevelt. Roosevelt recognized the economic wisdom of a higher minimum wage because it could increase the buying power of low-wage workers and help lift us out of the Great Depression. He recognized at the same time the moral purpose of the minimum wage. He declared that “no business which depends for existence on paying less than living wages to its workers has any right to continue in this country,” clarifying that “by living wages I mean more than a bare subsistence level—I mean the wages of decent living.”

Today, in Pennsylvania, it is vital not to lose sight of the workers and families who suffer by inaction.

We, the undersigned members of the Minimum Wage Advisory Board, conclude by noting that:

- An immediate increase to $12 per hour on a path to $15 per hour would have little or no negative employment impact—but a huge positive impact on working families.

- These increases would, in addition, benefit employers by enabling them to fill their job openings more quickly and retain more workers.

- And so that a rising cost of living does not erode the minimum wage once it reaches $15 per year, the minimum should thereafter be increased by the rate of inflation on an annual basis.

The undersigned members of the Minimum Wage Advisory Board urge the Pennsylvania legislature to take quick action on the minimum wage, so that our workers can support their families and begin to catch up with workers in surrounding states.

Stephen Herzenberg Nadia Hewka Barbara Johnson

Executive Director Senior Staff Attorney Representative

Keystone Research Center Community Legal Services UFCW Local 1776

Reesa Kossoff John Meyerson Samantha Shewmaker*

Executive Director Convener Communications Director

SEIU PA State Council Raise the Wage PA! PA AFL-CIO

*During March 2022, Samantha Shewmaker transitioned to a position as Communications and Policy Liaison, SEIU Local 668

END NOTES

[1] Minimum Wage Advisory Board (MWAB), “Analysis of the Pennsylvania Minimum Wage,” March 2022, p. 10; online at https://www.workstats.dli.pa.gov/Documents/Minimum%20Wage%20Reports/Minimum%20Wage%20Report%202022.pdf. MWAB, “Analysis of the Pennsylvania Minimum Wage,” March 2021, p. 10; online at https://www.workstats.dli.pa.gov/Documents/Minimum%20Wage%20Reports/Minimum%20Wage%20Report%202021.pdf.

[2] There were an estimated 50,000 Pennsylvanians earning below $7.25 in 2020. For this figure and the state’s ranking in 2020 compared to other states, see the Current Population Survey estimates in Table 3, online at https://www.bls.gov/opub/reports/minimum-wage/2020/home.htmhttps://www.bls.gov/opub/reports/minimum-wage/2020/home.htm.

[3] Ibid, page 10.

[4] Amy K. Glasmeier, Living Wage Calculator 2020, Massachusetts Institute of Technology, online at https://livingwage.mit.edu/.

[5] Full Pennsylvania chart at: https://livingwage.mit.edu/states/42. Within Pennsylvania, the ALICE project of the United Way generates county living-wage estimates that are very similar to those of the MIT Living Wage Calculator; see https://www.uwp.org/alice/about-alice/.

[6] Arindrajit Dube, professor of economics at the University of Massachusetts, Amherst, research associate at the National Bureau of Economic Research. February 2021, in The Washington Post: https://www.washingtonpost.com/outlook/2021/02/24/minimum-wage-economic-research-job-loss/

[7] Josh Bivens, David Cooper, Heidi Shierholz, and Ben Zipperer, Economic Policy Institute, February 2021: https://www.epi.org/blog/cbo-analysis-confirms-that-a-15-minimum-wage-raises-earnings-of-low-wage-workers-reduces-inequality-and-has-significant-and-direct-fiscal-effects-large-progressive-redistribution-of-income-caused/.

[8] Page 1446, https://doi.org/10.1093/qje/qjz014

[9] Occupational Employment and Wage Statistics, May 2020. May 2021 estimates are due out in the end of March/early April: https://www.bls.gov/oes/current/oes_pa.htm#00-0000.

[10] The 4.3% average increase from 2020 to 2021 is based the March 2020 to March 2021 period and on data from the Quarterly Census of Employment and Wages (QCEW). The latest available QCEW data are available from the Bureau of Labor Statistics at https://data.bls.gov/maps/cew/US.”