Newly released Census Bureau data show that median household income in Pennsylvania rose slightly in 2024, to $77,545. Nationally, median household income increased to $83,730 but was not statistically different from the 2023 estimate. Pennsylvania’s modest increase in household median income shows that households barely stayed ahead of inflation, a sign of progress, but also of ongoing pressure on family budgets.

We outlined longer-term wage trends in our recent State of Working Pennsylvania 2025 report. Over the past decade, wages for Pennsylvania workers at the 10th percentile outpaced inflation by $3.07 per hour. Most of these gains were seen in early pandemic years when employers were struggling to fill customer-facing service jobs. Pennsylvania’s lowest-wage workers still trail their counterparts in neighboring states, as every state that borders Pennsylvania has raised its minimum wage. Pennsylvania’s minimum wage remains at $7.25 per hour. In 2024, the 10th percentile earners in Pennsylvania earned an average of $1.12 less per hour than their counterparts working similar jobs in New York, Delaware, New Jersey, and Maryland. This is largely due to minimum wage policy differences. This gap translates to more than $2,300 a year difference for a full-time, year-round worker in Pennsylvania, a meaningful loss for families already struggling to make ends meet. With the addition of new work requirements for food assistance, Pennsylvania lawmakers should raise the minimum wage to at least $15 per hour to ensure that work is rewarded and Pennsylvania remains competitive.

National data on consumer sentiment, a metric that gauges how optimistic or pessimistic consumers feel about the economy, their personal finances, and future spending, shows continued unease about the state of the economy. Preliminary September 2025 data show that consumer sentiment declined, as consumers noted that trade policy was “highly salient” both during this and last month’s survey. Respondents noted multiple vulnerabilities in the economy, including business conditions, the labor market, and inflation. Low consumer confidence leads people to spend less, save more, and delay major purchases, which in turn ripples through the economy and results in weaker demand, cut production, and less investment.

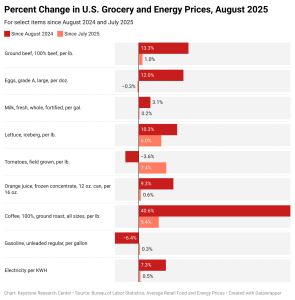

Inflation pressures remain particularly noteworthy. New Bureau of Labor Statistics data show that the 12 month overall Consumer Price Index inflation rate hit 2.9% in August, the biggest jump since January, up from a recent low of 2.3% in April. The “food at home” consumer price index rose 0.6% in August (2.7% annual rate), largely driven by the cost of beef, coffee, eggs, and other produce.

Together, these factors paint a complicated picture. Wages for many Pennsylvania workers inched upwards in 2024 but rising prices and policy gaps are limiting how far those gains go. For families living on tight budgets, even small differences in hourly pay or food costs have a significant impact on household choices. As consumer confidence slips and inflation remains a concern, Pennsylvania families look to leadership at the state level for stronger worker support and policies that ensure wages keep pace with the cost of living.

Explore how the prices of groceries and other staple items have changed over the last month and since August 2024. (BLS Average Retail Food and Energy Prices, August 2025)